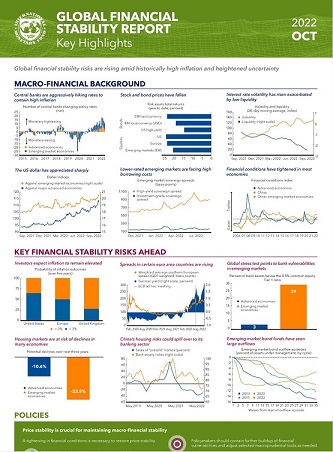

Chapter 1 analyzes the policy response of central banks to high inflation, the risks of a disorderly tightening of financial conditions, and debt distress among emerging and frontier markets. Markets have been extremely volatile, and a deterioration in market liquidity appears to have amplified price moves. In Europe, the energy crisis is contributing to a worsening outlook. In China, the property sector remains a key source of vulnerability. Chapter 2 examines how to narrow the climate financing gap in emerging market and developing economies. Climate policies, including carbon pricing, climate disclosures, and transition taxonomies, are crucial for enabling private climate finance. Innovative financial instruments can help to scale up private climate finance, but the public sector—including multilateral development banks—will have to play a key supporting role. Chapter 3 analyzes the contributions of open-end investment funds to fragilities in asset markets. Open-end investment funds play a key role in financial markets, but those offering daily redemptions while holding illiquid assets can amplify the effects of adverse shocks by raising the likelihood of investor runs and asset fire sales. This contributes to volatility in asset markets and potentially threatens financial stability.